In a bold, highly symbolic move that underscores his growing influence over U.S. economic policy, Elon Musk is calling for the elimination of the penny—America’s lowest-denomination coin—citing a shocking $179 million annual loss as justification. The initiative, driven by Musk’s newly-empowered Department of Government Efficiency (DOGE), is rapidly gaining traction among fiscal conservatives, technocrats, and even some everyday taxpayers who are increasingly questioning the necessity of the copper coin in an era dominated by digital transactions.At the heart of Musk’s campaign is a troubling fact: it costs more than three times the face value of a penny to produce one. According to the United States Mint’s 2024 annual report, each penny minted last year cost 3.69 cents.

The government produced nearly 3.2 billion pennies in 2024, incurring a direct loss of over $86 million. But when factoring in broader logistical costs—distribution, handling, and storage—the total financial waste attributed to the penny soars to an estimated $179 million in fiscal year 2023 alone.

DOGE, the brainchild of Musk’s drive to bring Silicon Valley-style optimization to federal bureaucracy, sounded the alarm in a sharply worded post to X (formerly Twitter) on January 21: “The penny costs over 3 cents to make and cost US taxpayers over $179 million in FY2023.”

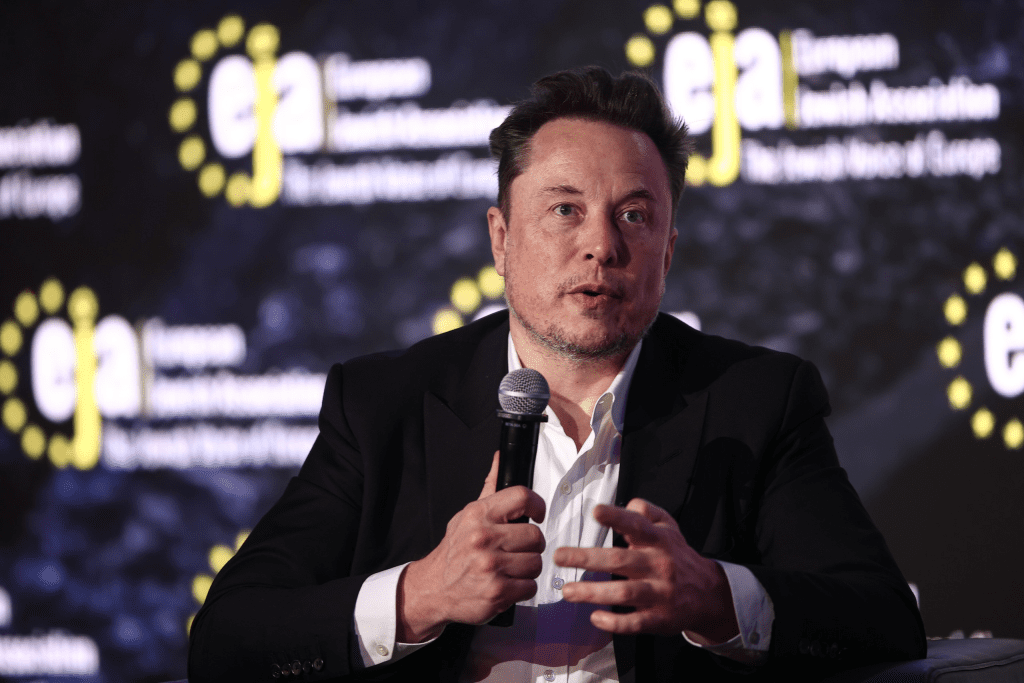

The reaction was immediate and visceral, with thousands of reposts, memes, and policy analysts weighing in within hours. The message was clear: Musk isn’t just tinkering with policy—he’s targeting inefficiency at its most minute level.While the penny has long been the subject of quiet policy debates, Musk is turning it into a national issue, using his celebrity status and position within the Trump-era government machinery to reframe it as a symbol of government waste. Speaking to a panel of DOGE advisors, Musk reportedly said, “Killing the penny is not just about saving money.It’s about proving we can fix what’s broken—even when it’s been broken so long people stopped noticing.”The numbers support his argument. The United States Mint has openly acknowledged the rising cost of producing low-denomination coins. For years, pennies have been minted at a loss. In 2023, the production cost was already over 2.7 cents, and that number has only climbed as material and labor costs increased.The bulk of the cost is due to the materials—primarily zinc and copper—and the energy-intensive minting process. That means each new penny dug out of federal funds essentially bleeds taxpayer money.

This may seem like an insignificant issue—after all, what’s a penny? But when multiplied by billions of units, the scale of the loss becomes undeniable. The implications are not just financial; they’re operational.Banks spend millions annually managing pennies. Businesses incur labor costs counting and storing them. Retail cashiers spend countless hours giving out pennies that customers often discard. Even the IRS must account for cents in millions of individual filings, adding complexity and potential errors to an already overburdened system.From a policy standpoint, Musk’s approach signals a shift away from sentimentality toward brutal pragmatism. DOGE, in its short lifespan, has already slashed more than $2.3 billion in what it calls “legacy inefficiencies,” terminating thousands of low-impact federal contracts and positions.The penny, for Musk, is not just a coin—it’s a metaphor. If the government can’t eliminate a single coin that loses nearly four times its value upon creation, what hope is there for addressing trillion-dollar structural deficits?

Historically, efforts to eliminate the penny have stalled. Former Congressman Jim Kolbe tried in the 1980s and again in the 1990s, only to face resistance from the zinc lobby and a public unwilling to part with what many viewed as a nostalgic piece of Americana.Even President Obama, in a 2013 virtual town hall, acknowledged the penny’s redundancy but admitted it wasn’t politically urgent enough to pursue. “People get emotionally attached to how things have always been,” Obama said.But times have changed. In 2025, digital payments dominate, and cash use is steadily declining. Younger generations rarely carry coins, let alone use them. The emotional attachment to the penny has weakened—if it ever truly existed. Now, with Musk wielding unprecedented sway and the U.S. public more conscious than ever of government waste, the climate for reform is ripe.So what happens if the penny is eliminated?In practical terms, prices would round to the nearest five cents. A product priced at $1.99 would round to $2.00, while $5.52 would round down to $5.50. Over time, these slight fluctuations would even out.

Studies from other countries—such as Canada, which eliminated the penny in 2013—show that rounding has negligible long-term effects on inflation or consumer purchasing power.Operationally, businesses would save money. Cash drawers would be simpler. Change-making would be faster. Banks would eliminate a costly logistical burden. Even federal accounting processes could be streamlined.And yet, despite executive pressure, the penny remains—for now.That’s because the United States Mint cannot unilaterally stop production. It is bound by law to mint all denominations authorized by Congress. Any permanent elimination of the penny would require legislation.While Musk has reportedly pushed the Treasury Department to “cease unnecessary production,” the Mint has confirmed that no changes to penny output have occurred to date.Insiders suggest that DOGE is currently preparing a broader “Waste Reclamation Act” to present to Congress later this year. While the bill remains under wraps, it’s expected to include a formal proposal to phase out the penny, among other small but costly legacy practices embedded in federal operations.

Meanwhile, public opinion appears to be shifting in Musk’s favor. A recent poll by Pew Research Center found that 61% of Americans support eliminating the penny, particularly when told that it costs more than 3 cents to make. Hashtags like #KillThePenny and #179MillionProblem have trended repeatedly on X, driven in part by Musk’s own engagement and reposts.Collectors, predictably, are watching closely. If the penny is scrapped in 2025, mints from this final year of production could quickly become sought-after collectibles. Dealers are already stocking up on uncirculated rolls in anticipation of a price spike, with some projecting a 300% markup by year-end.For now, the penny remains in circulation. But with mounting political will, public support, and undeniable economic logic, its days may be numbered.As Elon Musk continues his campaign to eliminate inefficiency from the federal system—whether it’s a bloated defense contract or a one-cent coin that costs three times as much to produce—one thing is clear: in the age of optimization, sentimentality is out, and smart spending is in.In Musk’s words, “We’re not just eliminating a coin. We’re eliminating a habit of losing.”